Unlock Your Home's Equity with an FHA Cash-Out Refinance

Access up to 80% of your home's value — even with less-than-perfect credit. FHA-backed. Flexible. Fast.

Access up to 80% of your home's value — even with less-than-perfect credit. FHA-backed. Flexible. Fast.

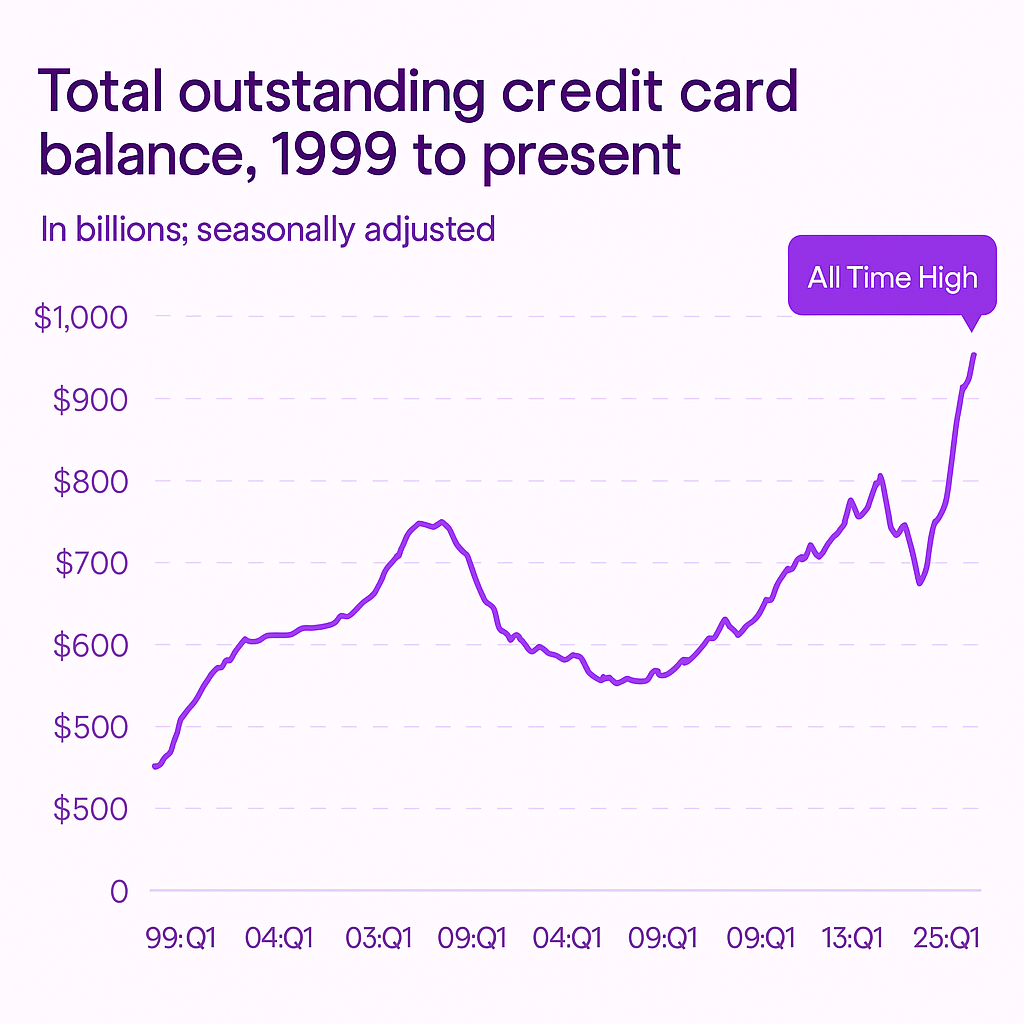

Tap into up to 80% of your home's value with our aggressive FHA Cash-Out Refinance program. Whether you're aiming to consolidate high-interest debts, fund home improvements, or cover major expenses, our streamlined process ensures you get the cash you need—quickly and efficiently.

Ideal for homeowners who:

Who Would You Rather Be? Would you rather do nothing and continue drowning in debt, or work with us to consolidate and slash your monthly payments?

Don't Wait Until It's Too Late To Take Control Of Your Finances

Check your FHA Cash-Out options—fast, easy, and no obligation.

Use the table below to see how it compares to conventional refinance and HELOC options — so you can choose the smartest way to access your home's equity.

| FHA Cash-Out | Conventional Cash-Out | HELOC | |

|---|---|---|---|

| Credit Score Requirement | 580+ | 680+ | 680+ |

| Max Loan-To-Value | 80% | ~75–80% | 85–90% |

| Fixed Interest Option | |||

| Government Backed | |||

| Cash Access Upfront |

Apply online and get prequalified (no credit impact).

We'll help you determine your home's current value and equity.

Finalize the FHA loan and access your funds in a lump sum.

We've Helped 15,112+ Homeowners Improve Their Financial Picture.

FHA loans can be complex — we simplify the process.

Close and fund in as little as 2-3 weeks.

No hidden fees, with clear communication at every step.

I have worked with the folks at Cazle Mortgage quite a few times now, and in my mind, there are no other options. Juan and Barry are nothing but class. I had the pleasure of working directly with Juan Escobedo on my most recent refinance and purchase of some investment properties and he helped to make the process completely seamless..

I had a fantastic experience with Cazle Mortgage! Their knowledgeable team provided exceptional service, guiding me through the process with ease. Their dedication, transparency, and commitment to finding the best terms made them my go-to choice for mortgages. Robin Peters was an amazing loan officer, I highly recommend her!

Me and My Wife had the pleasure of working with Robin Peters from Cazle Mortgage. She helped us get a Home Equity Loan and it was so easy working with her. She provided an estimate within $10 of what the actual payment would be when we talked. She was always honest and upfront about what to expect during the process..

At Cazle Mortgage, we've helped thousands of homeowners access equity through FHA-backed refinance solutions. Our licensed loan specialists guide you every step of the way — from application to closing — with clear communication and personalized options that work for your credit and financial goals..

Unlock Your Home's Potential